WHO WE ARE

Driving Accountability and Innovation in Africa's Digital Payment Ecosystem.

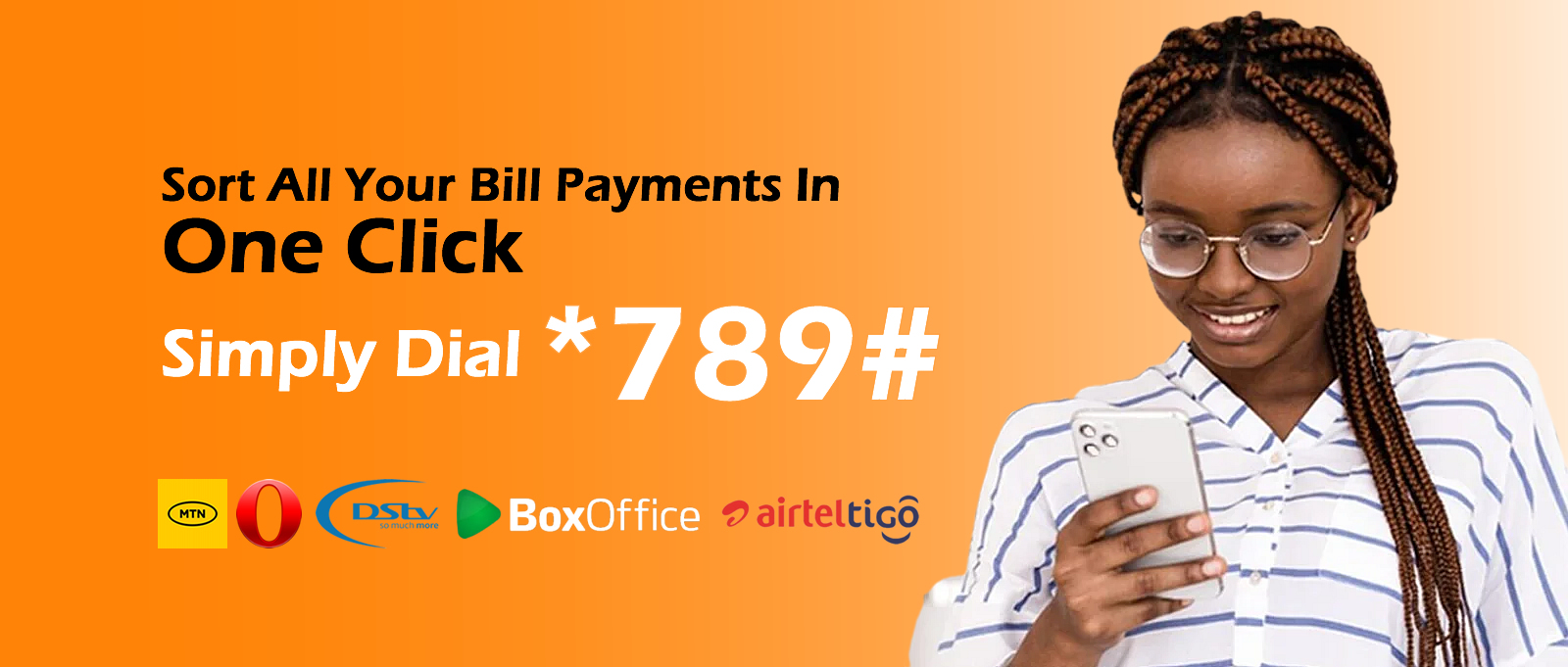

Emergent Africa is Ghana's leading digital payments solutions provider, empowering individuals, businesses, and institutions with secure and innovative financial technology. For over a decade, we've built a reputation for trust, transparency, and impact, helping to shape Africa's digital economy.

OUR VISION

To become Africa's most trusted payments partner where technology, security, and innovation meet to deliver lasting impact.

OUR MISSION

To simplify payments, and unify financial inclusion and drive growth for Africa's businesses and communities

Powering secure payments for millions across African markets.

Over a decade of innovation in digital finance.

Live number of markets moving right now

Trusted by merchants expanding into Africa's digital economy.

Certifications

Our certifications reflect a strong commitment to professionalism, reliability, and globally recognized standards. They highlight our dedication to maintaining secure, compliant, and high-quality practices across all operations, helping build trust and confidence with every client we serve.

We follow DPC guidelines to ensure safe and compliant handling of personal data.

Our processes align with ISO 27001 standards, ensuring strong security controls and protection of sensitive information.

We follow PCI-DSS best practices to keep payment data secure and maintain safe transaction processes.

Our Leaders

FAQS

Get quick insights to popular concerns

What Is Emergent Payments Ghana Limited ?

We’re an electronic payment platform that makes traditional transactions and ecommerce simpler, secure, and more convenient. We do this by making it possible for you, the merchant, to receive payments of bills, invoices, and fees anytime and anywhere through a wide variety of local and international payment channels.Clients love us because we don’t inflate prices; we deliver premium quality at a price that makes sense and a result that feels 100% worth it. See the full pricing on our pricing page.

What are payment options available to my customer as a Emergent Payments merchant?

- Visa/MasterCard

- Mobile Money (MTN, Mobile Money, Airtel Money, Tigo Cash, Vodafone Cash)

- GHLink

- Cash at Emergent Payments banks (First Atlantic Bank, Universal Merchant Bank, The Royal Bank, Energy Bank, Capital Bank, Access Bank, GT Bank)

- Slydepay

- Via their Emergent Payments wallets

How do I collect payments as an Emergent Payments merchant?

As an Emergent Payments merchant, you can receive payments from your customers in four different ways. They are:

- WebPoint of Sale Service (webPOS)

- Open Merchant platform

- Direct Debit of customer’s bank account

- Cash at Emergent Payments bank

Send us an e-mail at info.africa@emergentafrica.com or give us a call at +233 302 263014 and we would love to give you more details.

Do my customers need to have Emergent Payments wallets to pay me?

No, your customers don’t need to have Emergent Payments wallets to pay you via Visa/MasterCard, mobile money, GHLink, or cash. Payment via their Emergent Payments wallet is just one of the many payment options available to them.

What are some of the benefits of being an Emergent Payments merchant?

- You will grow your customer database and improve your sales by being able to receive payments through a wide variety of local and international payment options

- You operate in a paperless environment and reduce the risks that come with handling cash and paper receipts – loss through theft, fire, and other occurrences

- You will be able to receive payments from your customers all over Ghana and all over the world 24/7

- You receive instant notification when a payment is made, which makes it possible for you to track all your payments

- You have real time access to your transaction history which makes it easy for you to reconcile all your customers’ payments

- You have the ability to customize your Emergent Payments dashboard with added features such as the ability to broadcast notices such as discounts and sales, new products, and new services to your customers

How do I sign up to become an Emergent Payments merchant?

Send us an e-mail at info.africa@emergentafrica.com or give us a call at +233 302 263014 and we will set you up. We are the future of payments and we would love for you to join us!

How much does it cost to become an Emergent Payments merchant?

It is absolutely free to integrate your website, app, or offline payment system with Emergent Payments, as our fees are transaction-based.

Who can be an Emergent Payments merchant?

Any company, organization, or institution that receives money from customers or members can be an Emergent Payments merchant. Our portfolio of merchants is highly diverse; what they have in common is that they want to give their customers flexibility, security, and convenience when it comes to making payments. The list of Emergent Payments merchants includes institutions such as the Project Management Institute (PMI), schools such as Regent University, pension companies such as People’s Pension’s Trust, financial institutions such as Beige Capital (Asset Management Division), and associations such as Blogging Ghana.

What are some of the benefits of having an Emergent Payments wallet?

- You can pay your fees, bills, and invoices instantly and securely anytime and anywhere

- You reduce the risk of using cash and of exposing your bank account when it comes to making payments

- You have real time access to a transaction history to help you track all your payments

- You can top up your Emergent Payments wallet from anytime and from anywhere

- You’re the first to know when your merchant is running a sale, has some important information about member or student registration, or has a general announcement for its customers

How do I get my Emergent Payments wallet?

Follow this link Register to enter your registration details and to transform the way you make payments.

I’m having difficult logging into my bank’s Emergent Payments interface!

Kindly contact the IT support from your bank. They are in the best position to assist you.

I’m experiencing some browser-related issues on my bank’s Emergent Payments interface!

We found that our interface works best with the following versions of these common browsers:

- Internet explorer – version 10 or higher

- Mozilla Firefox – version 25 or higher

- Google chrome – version 37 or higher

How do I check if my browser is compatible to the Emergent Payments interface?

Internet Explorer

- Place your cursor on the Internet Explorer menu bar and on the keyboard click on “Alt”

- Go to “Help” on the task bar and click on it

- Select “About Internet Explorer” and it will display the details of your computer’s current Internet Explorer version details

- Update Internet Explorer if necessary

Mozilla Firefox

- Click on “Help” on the menu bar

- Click on “About Mozilla Firefox” and it will display the details of your computer’s current Mozilla Firefox version

- Update Mozilla Firefox if necessary

Google Chrome

- Click on the button on the right corner of the menu bar

- Select “About Google Chrome” and it will display the details of your computer’s current Google Chrome version

- Update Google Chrome if necessary